BUSINESS CASE

PRODUCT STRATEGY

BACKGROUND

How do we prepare an incumbent and category-leading investment platform to meet a fast-changing future and the next stage of product evolution, with intention?

Over the years, ICICI Direct had grown to meet a wide range of investor needs. But as the ecosystem evolved, so did its complexity: more features, more users, more expectations, more friction.

THE PROBLEM STATEMENT

EXECUTION STRATEGY

WHAT OUR RESEARCH TOLD US

Our research uncovered that the same product was meant to serve two diversely different sets of user needs that ICICI DIrect was courting.

User 1

DIY investors

Investors in their 30s - 50s, are focused on families, retirement, and major life goals. They prefer steady, safe wealth-building over chasing the market, and need apps that feel calm, clear, and trustworthy. Simple layouts, direct information, and contextual guidance help them stay in control.

Active traders

Traders, spanning younger to older age groups, treated trading as a daily habit or parallel profession. They don’t want lessons. They want speed, clear information, and precision in fast-moving markets. For them, an app must be a Swiss army knife: lean, reliable, and always ahead.

01 | UPGRADING THE CURRENT APP

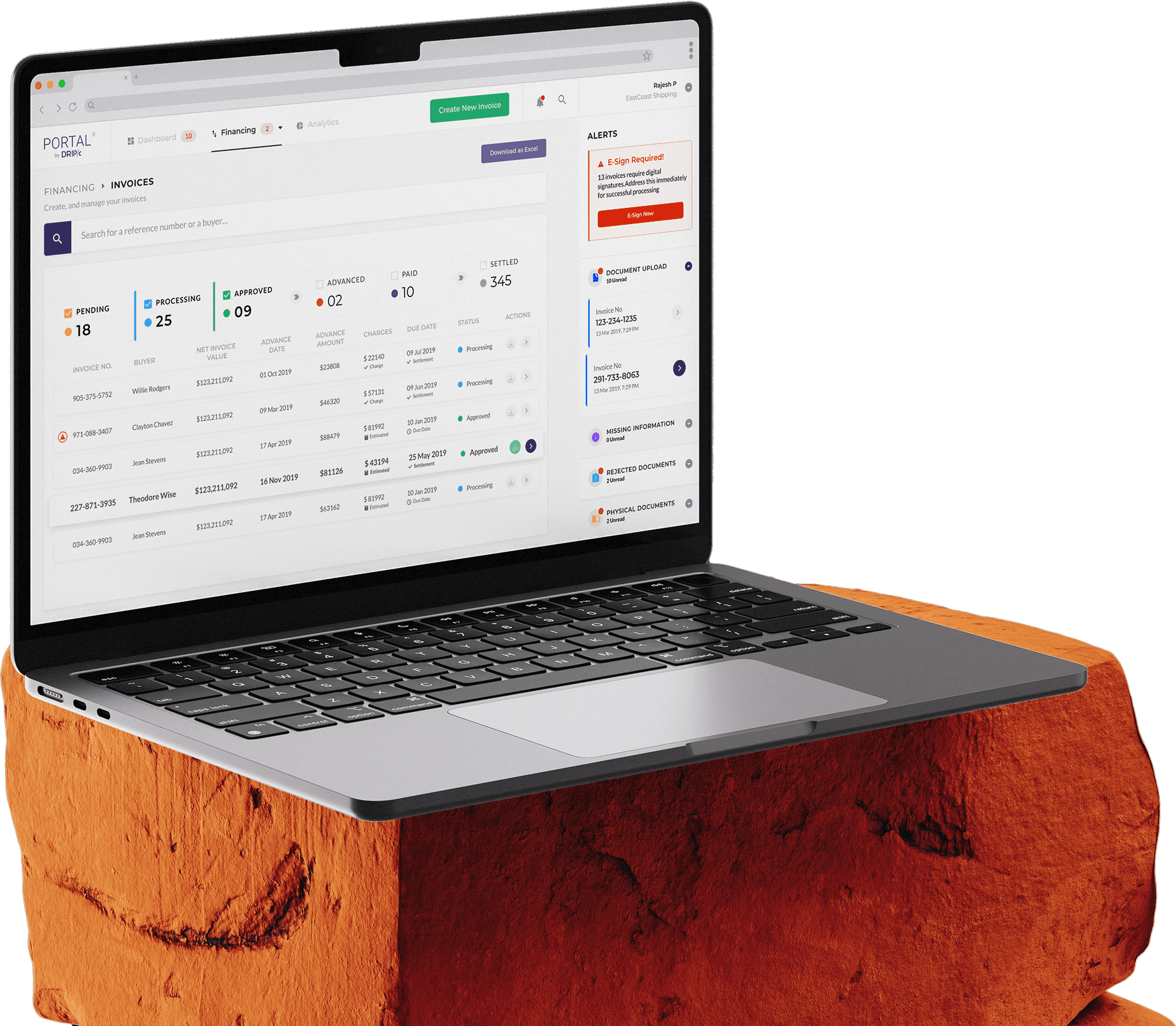

We made fundamentally visual design upgrades to the current application without changing any structure. The focus was on typography, colour usage, component consistency and spacings.

02 | DESIGNING FOR DIVERGENCE

Watchlisting made better

Our worked on this product has not ended at just launch - we have a whole case talking about all the work, iterative and additive to this financial stack post launch.